YOU ARE HERE Home > Blogs > E-Invoice and Tax Department

E-Invoice and Tax Department

GST DOST's BLOG

| Ownership | Own | ||

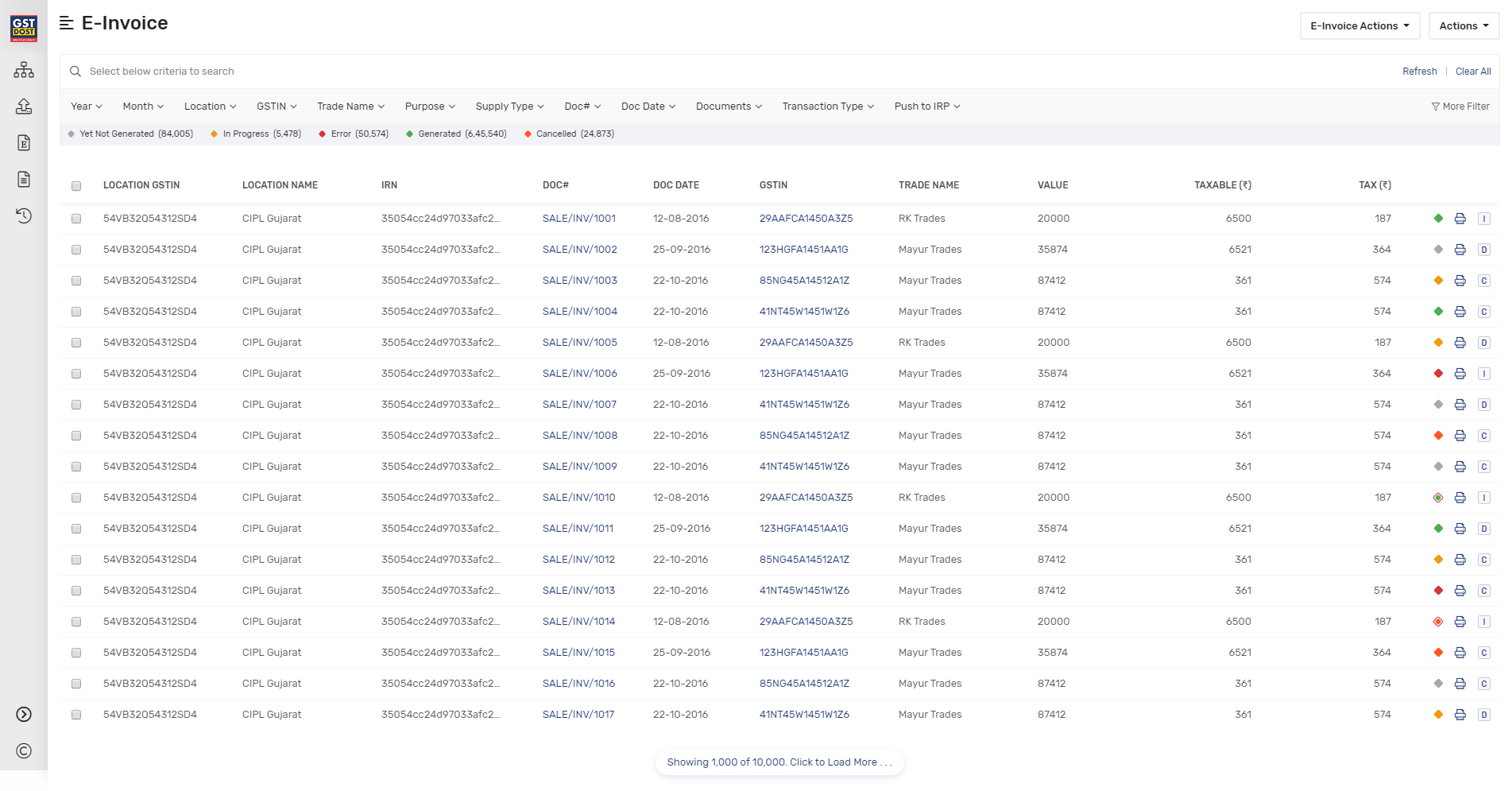

The e-invoice system being implemented by tax departments across the globe consists of two important parts namely,

a) Generation of invoice in a standard format so that invoice generated on one system can be read by another system.

b) Reporting of e-invoice to a central system.

The basic aim behind adoption of e-invoice system by tax departments is ability to pre-populate the return and to reduce the reconciliation problems. Huge increase in technology sophistication, increased penetration of Internet along with availability of computer systems at reasonable cost has made this journey possible and hence more than 60 countries are in the process of adopting the e-invoice.

GST Council has given the responsibility to design the standard of e-invoice and update the same from time to time to GSTN which is the custodian of Returns and invoices contained in the same.

Adoption of e-invoice by GST System is not only part of Tax reform but also a Business reform as it makes the e-invoices completely inter-operable eliminating transcription and other errors.

Allahabad High Court Provides Relief to Businesses in Landmark GST e-Way Bill Ruling. [News]

GST Amnesty Scheme: A Golden Opportunity, But Heed the Advisory - Tax Samachar [News]

Madras High Court Quashes ITC Claim Rejection Based Solely on GSTR-3B and Directs Authorities to Consider Other Returns like GSTR 2A and GSTR 9. [Blog]

Supreme Court Upholds Statutory Immunity for Officers Under GST Act: A Closer Look at the Landmark Decision [Blog]

Consultant के Foreign Client पर GST का Impact [Video]

Goods Transport Agency और Multimodel Transporter अलग अलग है [Video]