YOU ARE HERE Home > Blogs > Type of documents are to be reported to GST System.

Type of documents are to be reported to GST System.

GST DOST's BLOG

| Resource | Chapter 91 |

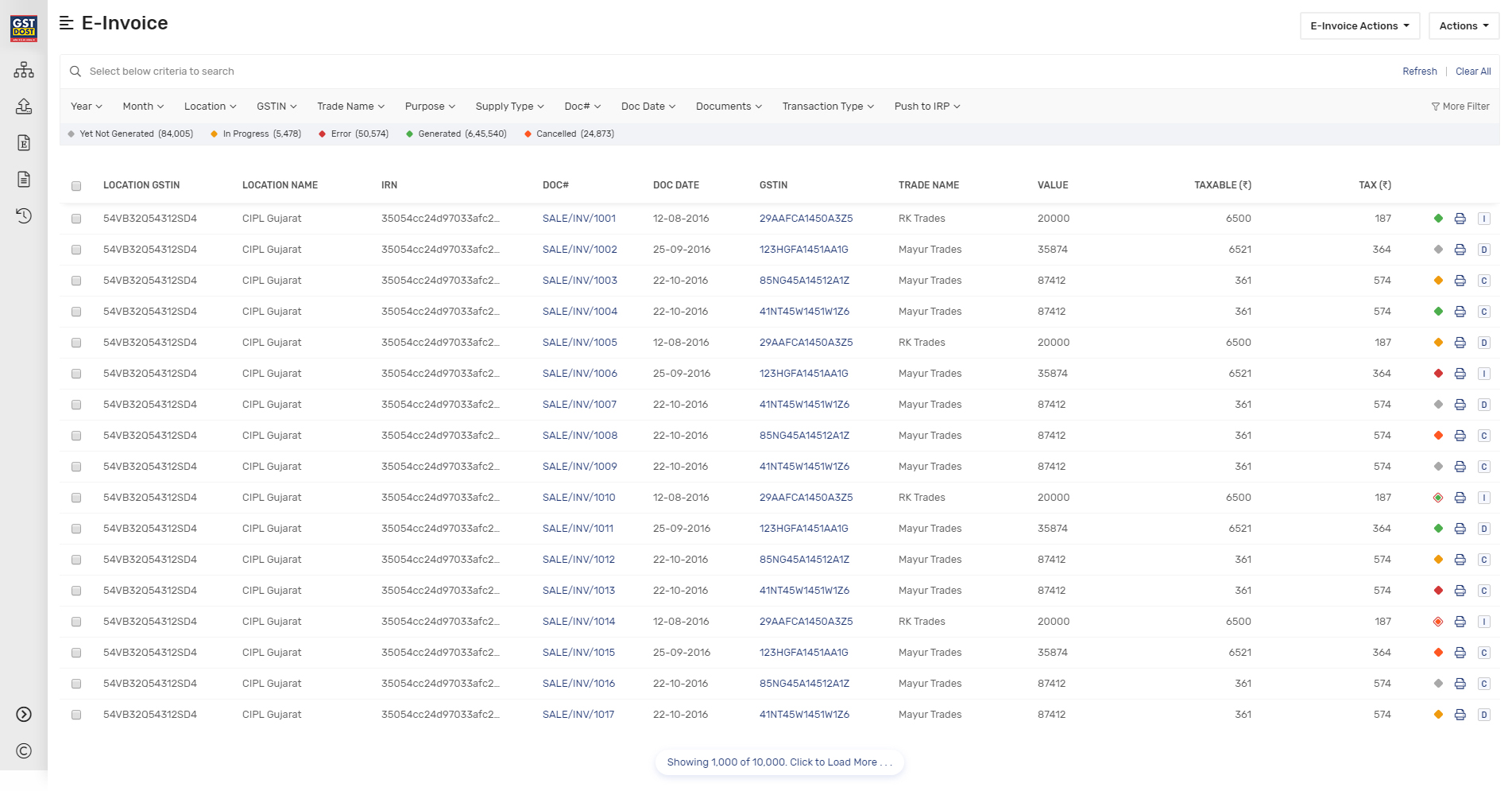

While the word invoice is used in the name of e-invoice, it covers other documents that will be required to be reported to IRP by the creator of the document:

i. Invoice by Supplier

ii. Credit Note by Supplier

iii. Debit Note by Supplier

iv. Any other document as required by law to be reported by the creator of the document (as notified by the Government from time to time).

Allahabad High Court Provides Relief to Businesses in Landmark GST e-Way Bill Ruling. [News]

GST Amnesty Scheme: A Golden Opportunity, But Heed the Advisory - Tax Samachar [News]

Madras High Court Quashes ITC Claim Rejection Based Solely on GSTR-3B and Directs Authorities to Consider Other Returns like GSTR 2A and GSTR 9. [Blog]

Supreme Court Upholds Statutory Immunity for Officers Under GST Act: A Closer Look at the Landmark Decision [Blog]

Consultant के Foreign Client पर GST का Impact [Video]

Goods Transport Agency और Multimodel Transporter अलग अलग है [Video]