YOU ARE HERE Home > Blogs > GST TRAN-1 extend due date not for Rule 118, Rule 119 and Rule 120.

GST TRAN-1 extend due date not for Rule 118, Rule 119 and Rule 120.

GST DOST's BLOG

| Resource | Chapter 44 |

| Resource | GST TRAN-1 Form |

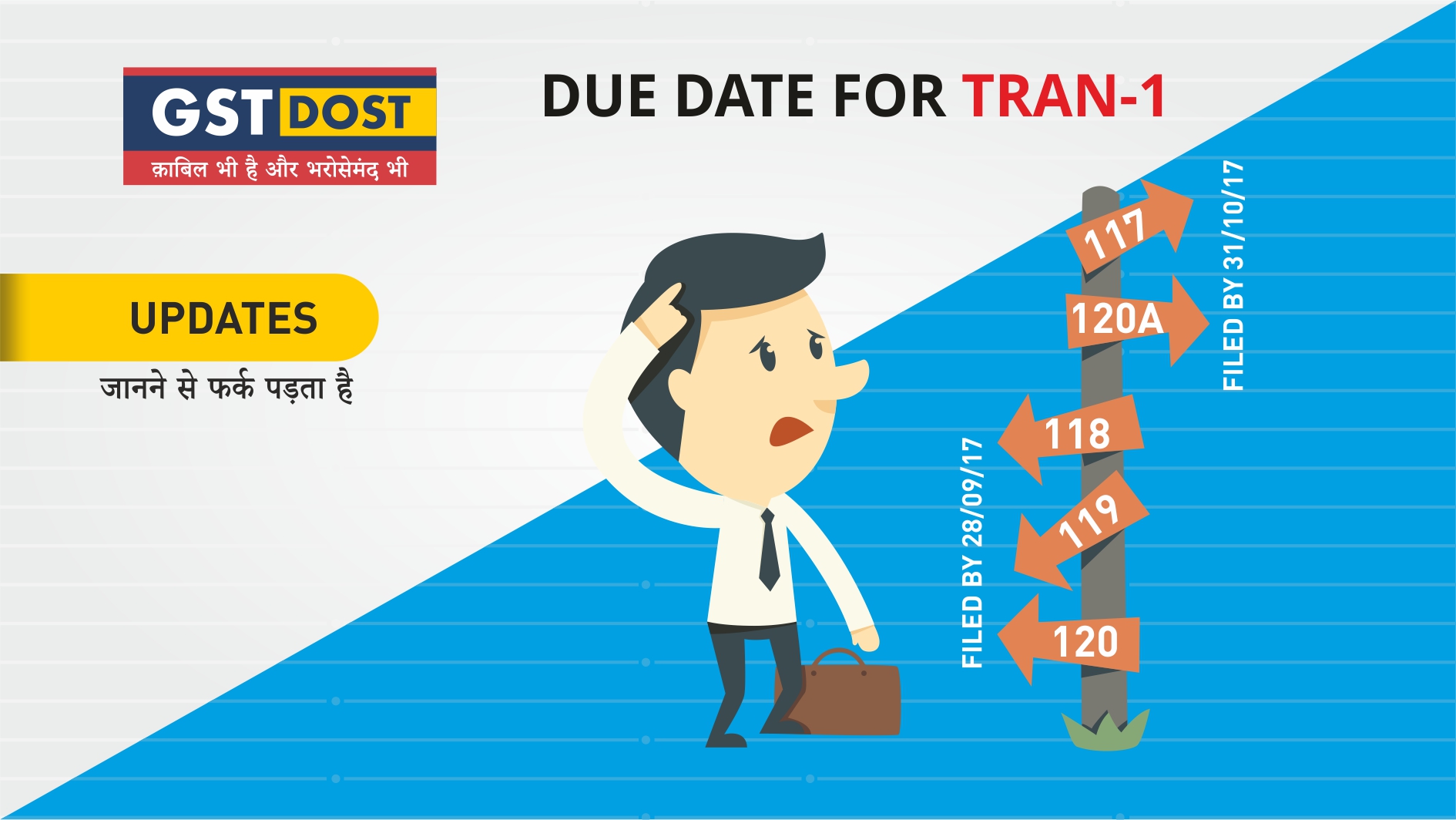

Order 02 and Order 3 extend due date for TRAN-1 only for Rule 117 and Rule 120 A of CGSTRules 2017.

No Extension for Rule 118, 119 amd 120 of CGST Rules 2017.

118. Declaration to be made under clause (c) of sub-section (11) of section 142.-

Every person to whom the provision of clause (c) of sub-section (11) of section 142 applies, shall within a period of ninety days of the appointed day, submit a declaration electronically in FORM GST TRAN-1 furnishing the proportion of supply on which Value Added Tax or service tax has been paid before the appointed day but the supply is made after the appointed day, and the Input Tax Credit admissible thereon.

119. Declaration of stock held by a principal and job-worker.-

Every person to whom the provisions of section 141 apply shall, within ninety days of the appointed day, submit a declaration electronically in FORM GST TRAN-1, specifying therein, the stock of the inputs, semi-finished goods or finished goods, as applicable, held by him on the appointed day.

120. Details of goods sent on approval basis.-

Every person having sent goods on approval under the existing law and to whom sub-section (12) of section 142 applies shall, within ninety days of the appointed day, submit details of such goods sent on approval in FORM GST TRAN-1.

Allahabad High Court Provides Relief to Businesses in Landmark GST e-Way Bill Ruling. [News]

GST Amnesty Scheme: A Golden Opportunity, But Heed the Advisory - Tax Samachar [News]

Madras High Court Quashes ITC Claim Rejection Based Solely on GSTR-3B and Directs Authorities to Consider Other Returns like GSTR 2A and GSTR 9. [Blog]

Supreme Court Upholds Statutory Immunity for Officers Under GST Act: A Closer Look at the Landmark Decision [Blog]

Consultant के Foreign Client पर GST का Impact [Video]

Goods Transport Agency और Multimodel Transporter अलग अलग है [Video]