Read to find out why just Filing for and getting a GST refund is not Enough for your Business?

GST DOST's BLOG

Namaste!

We hope this blog finds you in the best of your health.

Today, we wanted to talk to you about an important GST concern that we believe you must know about. It is a common perception among Businessmen that mere filing for and getting a GST refund is all that needs to be done.

However, this is not actually the case, especially after the introduction of Post Refund Audits. Cases, where Businesses apply for more refund than what they are supposed to, are pretty common these days.

During these Audits, if it is found out that the applied-for refund is more than the actual amount (even when it is just a mistake, which is extremely common with Businesses these days), the refund would be treated as an Erroneous Refund.

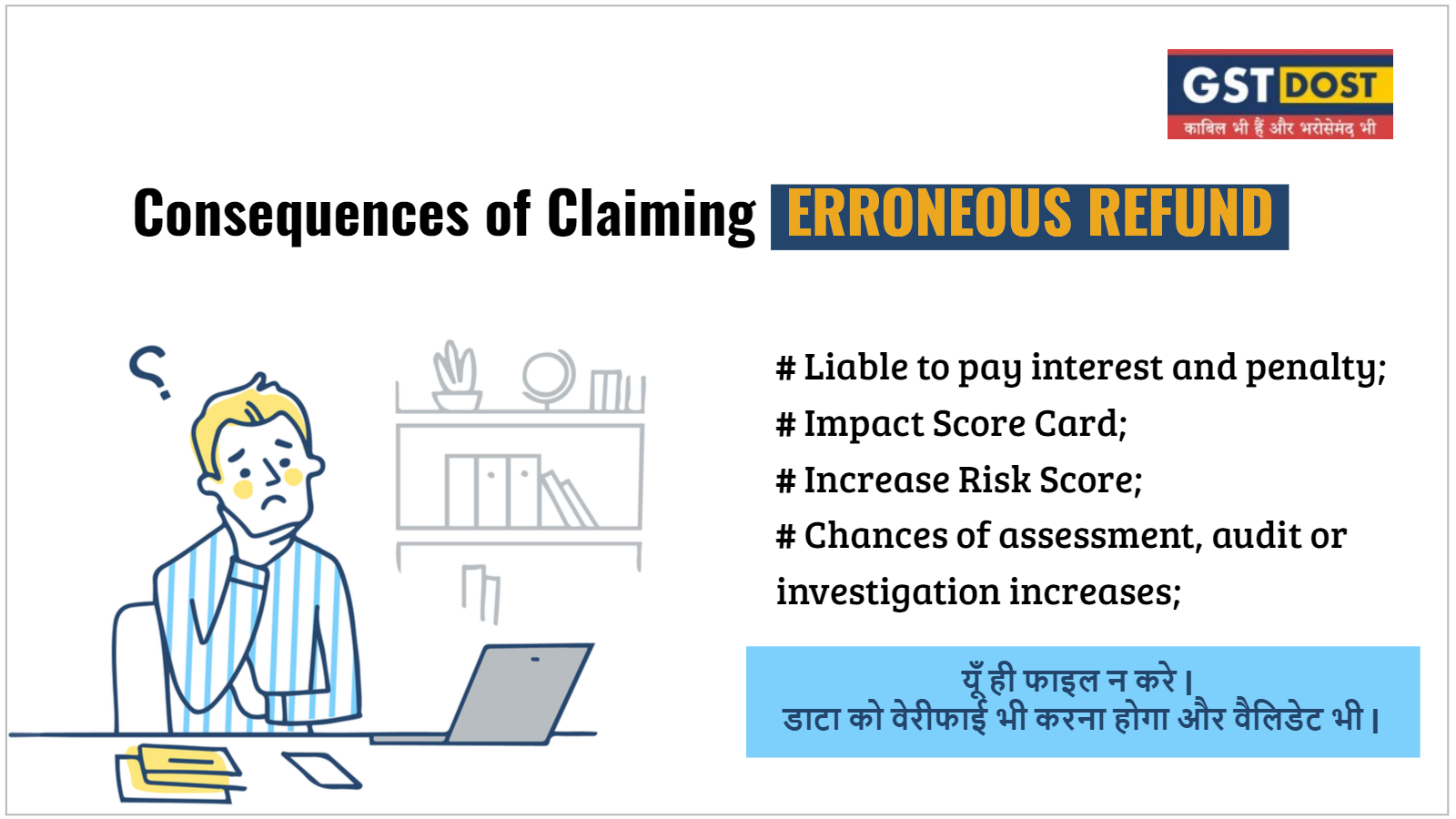

Consequences of claiming Erroneous Refund

Then, the Business will have to pay the penalty along with interest for the said Tax amount.

We will discuss a few scenarios, which will give you an idea of why it is very likely for Businesses to apply for the wrong refund amount when their GST tasks are not handled properly.

The details of erroneous refund disclosed in Pt. V, Table 15 of GSTR 9 (Annual Return) and Pt. V of GSTR 9C (GST Audit Report). Due to this also, you will lose a lot of points in the SCORECARD maintained by the Department and increase your RISK SCORE, and the chances of assessments, investigations, Audits, etc., would also increase in your specific case.

This is why we talk about the importance of taking due care of numerous factors before calculating the amount of refund. Avoiding taking the help of a GST professional or compromising on getting experts can eventually result in loads of problems for your Business.

Businesses need to avoid starting a chain of Audits that can start from a small mistake while filing their Taxes or refunds.

Let's understand the concept with an Example

Sooraj is an exporter who does his exports in two ways: Exports with payment of IGST and Exports without payment of IGST, i.e., with LUT.

Now, it is essential to understand that setting off ITC is allowed when ITC has been received from capital goods under IGST refund. However, the same is not permitted in the case of a LUT refund.

Now, the same Business buys a laptop for Rs. 1 Lakh and pays Rs. 18,000 as GST for the purchase. After the payment, the Business claimed ITC under GSTR 3B and adjusted it with the output liability. There is no issue in such a case as adjusting the amount is allowed as per the rules.

But this is not the case with LUT refund; when you read Rule 89(4) of LUT refund properly, you will find out that the ITC accumulated from capital goods is not supposed to be considered in refund calculation. Now, the refund claimant has to take care of the rules and not apply for any amount more than what is allowed.

It is common for Businesses to apply for such refunds due to a lack of knowledge of the rules. The Officer also issues the refund in most cases after checking the amount being reflected in GSTR 2A.

It is natural because GST Officer usually rely on the business or his representative and looks at only those invoices at the time of refund, which are not reflected in GSTR 2A or huge.

But the problem starts in the Post Refund Audit. The Audit Officer checks the documents and Invoices and finds out the mistake. On spotting the issue, the Officer would raise a demand for the amount along with a penalty and interest amount, generally u/s 74. Not only this, but the Officer would also raise a red flag in the internal scorecard.

How can an Experienced Consultant help you even in such a scenario?

An experienced GST consultant would help you even in such scenarios and help you prevent loads of mistakes. He/She will draft a reply which will make the issue a mistake and not a deliberate deception.

There is a big difference between the two, as your case is then considered in Section 73 instead of Section 74, and by paying the amount on the spot, you can avoid getting the Show Cause Notice!

You can also prevent getting red flags on your scorecard with this method.

Small facts and techniques like these make GST "Easy Se Bhi Aasaan" when you have an expert, experienced and competent consultant for your Business.

The only parameter for selecting a consultant should not be "Lesser Fees", but the parameters should be defined by various factors. The expert, experienced and competent consultant should help you like a DOST and take a holistic view of your business while protecting it from issues in the now and future.

The right GST consultant should protect your Business from various kinds of Business and give you peace of mind so that you can focus on your Business and grow it!!!

Thanks & Regards

DOST Vikash Dhanania

Allahabad High Court Provides Relief to Businesses in Landmark GST e-Way Bill Ruling. [News]

GST Amnesty Scheme: A Golden Opportunity, But Heed the Advisory - Tax Samachar [News]

Madras High Court Quashes ITC Claim Rejection Based Solely on GSTR-3B and Directs Authorities to Consider Other Returns like GSTR 2A and GSTR 9. [Blog]

Supreme Court Upholds Statutory Immunity for Officers Under GST Act: A Closer Look at the Landmark Decision [Blog]

Consultant के Foreign Client पर GST का Impact [Video]

Goods Transport Agency और Multimodel Transporter अलग अलग है [Video]