More Important than Ever to Comply with GST keeping Budget 2018 in Mind!

बजट 2018 को ध्यान में रखकर करने होंगे जीएसटी कंप्लायंस में बदलाव

GST DOST's BLOG

| Resource | Chapter 43 |

| Resource | GST Discussion |

More Important than Ever to Comply with GST keeping Budget 2018 in Mind!

Change is the only constant. There are huge setback examples to prove this. Businesses as huge as the Sahara desert and as majestic as the city of Atlantis have bitten dust because of their inability to adjust to changes with time. The idea is not to stay stiff where your business processes are concerned. A lot of people in the past held the opinion that they could run their business the way have always been and that adjustments were not required. As a result, most of them has either dissolved or have adjusted after taking lessons the hard way.

There is no bigger example than Technology in the recent times. We have seen it advancing from a mere spark to having an impact on almost everything in our life. We have grown from using typewriters to palm-sized mobile phones that fit easily in our pockets. Time has certainly changed. It is the era of robotic technology and artificial intelligence. India’s first driverless metro train in Delhi has gone further to prove that.

Our point is: you have to adjust and move forward, or else you will stay behind in the race towards progress. And this holds true in terms of running business as well. A lot has changed in the past few months. The ways of maintaining documents, updating accounts and keeping records has changed considerably, and we all, for our own sake, must understand them thoroughly to prevent our businesses from heavy loss.

In public interest, let me bring your attention towards a few highlights of the new budget that are bound to impact businesses in India. You are requested to pay attention to the information below and make changes in your business processes accordingly.

1. Union Budget 2018 proposed in sec. 139A of the Income Tax Act 1961 that every person, not being an individual, which enters into a financial transaction of an amount aggregating to Rs 2,50,000/- or more in a financial year shall be required to apply to the Assessing Officer for allotment of PAN.

It has also been mentioned previously that it necessary for every entity including indoviduals to have a PAN in case carrying on any business or profession where total sales, turnover or gross receipts are or is likely to exceed Rs 500000/- in any financial year. Amendment is also made in case of cash expedntirue for trust. There is a cap on cash sale and cash purchase also.

PAN number will used as the Unique Entity Number (UEN). Here it is important to understand that the government may decide to link the provision of Sec. 139A with sec.285-BA of the Income Tax or any other provision of the Act directly or indirectly on account of transpeancy and as an anti evasion balck money measure.

In any case, it is mandatory in GST to mention the address of the buyer in the case the Invoice Value exceeds Rs. 50,000 in cash.

Hencefoth, I visaulise that it will become hard to purchase or sell in cash in near future.

2. The Finance Minister also stated in the budget that

Quote

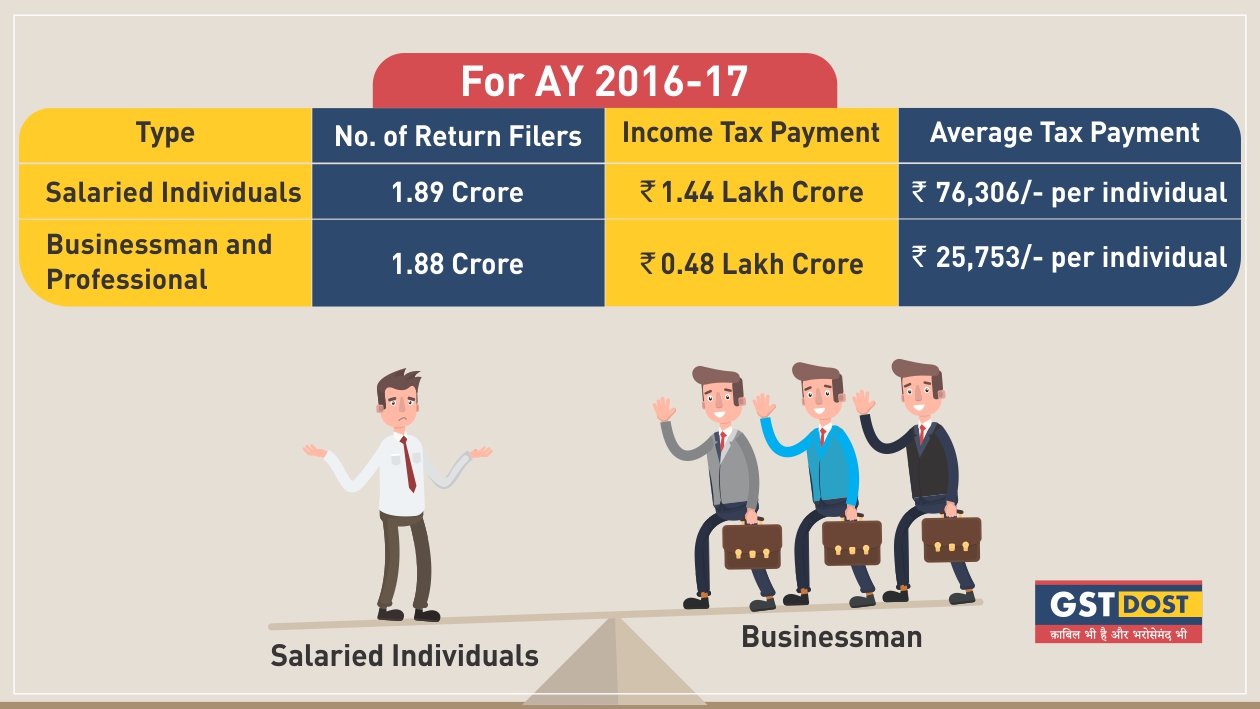

*** For assessment year 2016-17, 1.89 crore salaried individuals have filed their returns and have paid total tax of `1.44 lakh crores which works out to average tax payment of `76,306/- per individual salaried taxpayer. As against this, 1.88 crores individual business taxpayers including professionals, who filed their returns for the same assessment year paid total tax of `48,000 crores which works out to an average tax payment of `25,753/- per individual business taxpayer. ***

Un-Quote

The stats are enough to prove that the Government has reliable facts and figures and also conveyed to the citizen of India time to time.

Earlier, it was also conveyed in the recent seminar on E-Way Bill that it will be possible to effectively monitor movement of goods through an online portal that is designed specifically for this purpose.

This means that is even more important to furnish correct data and information in the return and not just comply with the Rules and Regulation of GST.

3. The concept of E-Assessment has been introduced in Income Tax and it will be implemented soon in GST as well.

The Government is working on Data Warehousing and Cloud Computing fully functional in this domain. This has been used on the E-Way Bill portal where anyone can generate, update or verify E-Way Bill online or even through an SMS. As a matter of fact, everything is going online. Almost every document or information requested will be expected to be sent over through an email.

To ensure you can instantly send information, documents and records in the acceptable format within the specified time, you will have to maintain accounts and keep documents & records up-to-date on a computer.

4. Union Budget 2018 proposed to onboard public sector banks and corporates on Trade Electronic Receivable Discounting System (TReDS) platform and link this with GSTN. In such a case, your records can easily be frisked and information collected if you borrow or lend loans.

Allahabad High Court Provides Relief to Businesses in Landmark GST e-Way Bill Ruling. [News]

GST Amnesty Scheme: A Golden Opportunity, But Heed the Advisory - Tax Samachar [News]

Madras High Court Quashes ITC Claim Rejection Based Solely on GSTR-3B and Directs Authorities to Consider Other Returns like GSTR 2A and GSTR 9. [Blog]

Supreme Court Upholds Statutory Immunity for Officers Under GST Act: A Closer Look at the Landmark Decision [Blog]

Consultant के Foreign Client पर GST का Impact [Video]

Goods Transport Agency और Multimodel Transporter अलग अलग है [Video]

.jpg)