YOU ARE HERE Home > Blogs > CMP-3 Submission Date Extended by a Month

CMP-3 Submission Date Extended by a Month

GST DOST's BLOG

| Resource | Chapter 44 |

| Resource | GST Discussion |

| Resource | Composition Scheme |

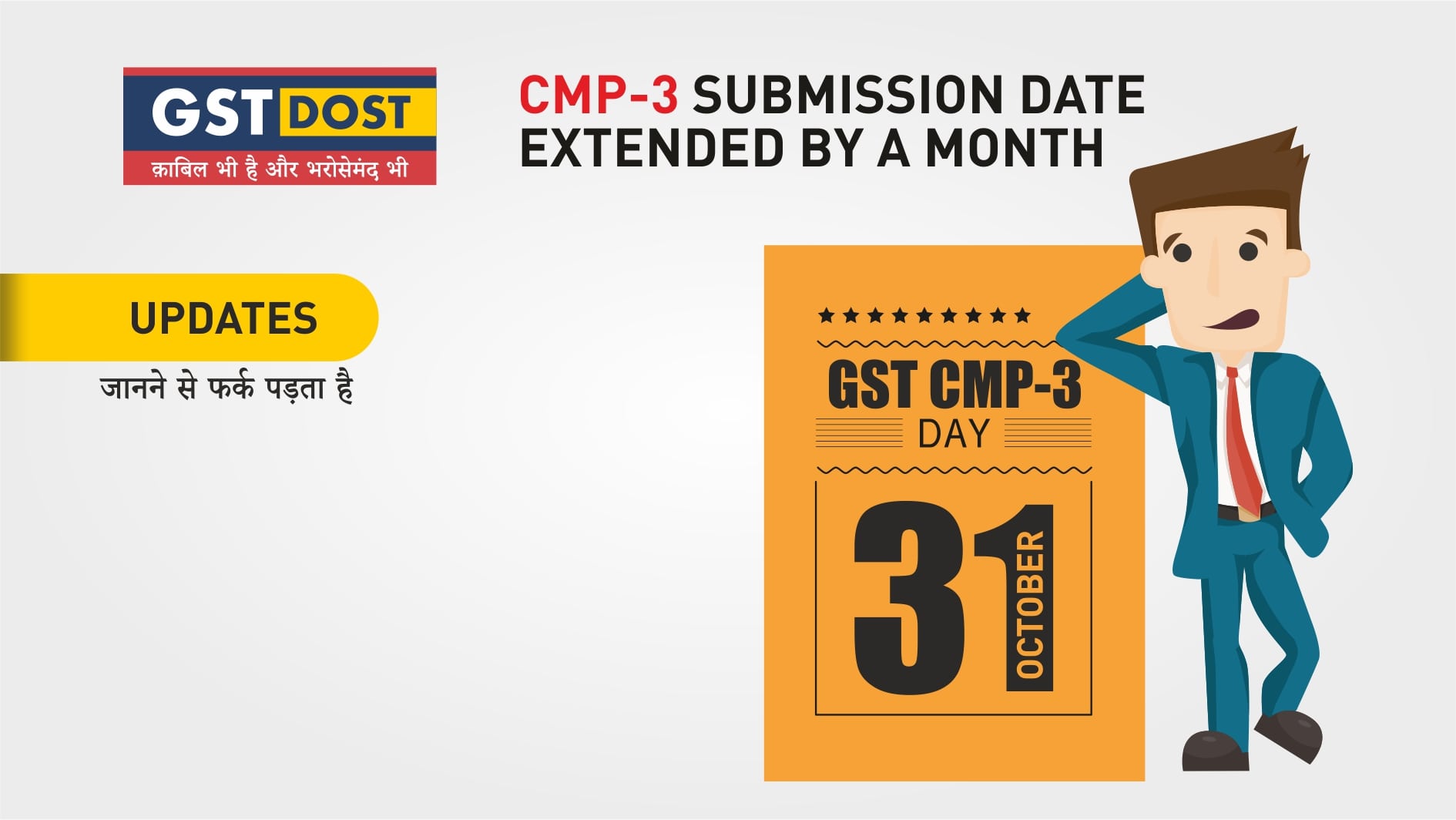

The last date for submitting CMP-3 return form has been extended by one month to 31/10/2017. Only businessmen who have availed Composition Scheme in GST are supposed to submit this form. Earlier, the last date for submitting CMP-3 return form was September 30.

Under GST, businessmen with annual turnover of up to Rs. 75 lakh can avail the benefit of composition scheme. They are exempt from furnishing every month’s transaction details by merely paying 5% tax. The businessmen were supposed to provide details of stock through this form by September 30.

Businessmen are expected to furnish plenty of details in the CMP-3 form. They are expected to provide details such as tax paid and unpaid stock. Also, it is mandatory for them to pay tax on unpaid stock as per the current applicable GST rate. The entire process is cumbersome and time-consuming for a businessman who has other important things to focus on. Now that the date has been extended by a month, it has come as a relief to them.

Feel free to get in touch with GST DOST for help.

Form GST –CMP-03

[See rule 3(4)]

Intimation of details of stock on date of opting for composition levy

(Only for persons registered under the existing law migrating on the appointed day)

|

1. GSTIN |

|

||

|

2. Legal name |

|

||

|

3. Trade name, if any |

|

||

|

4. Address of Principal Place of Business |

|

||

|

5. Details of application filed to pay tax under section 10 |

(i) Application reference number (ARN) |

|

|

|

(ii) Date of filing |

|

||

|

6. Jurisdiction |

Centre |

State |

|

7. Stock of purchases made from registered person under the existing law

|

Sr. No |

GSTIN/TIN |

Name of the supplier |

Bill/ Invoice No. |

Date |

Value of Stock |

VAT |

Central Excise |

Service Tax (if applicable) |

Total |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

1 |

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

8. Stock of purchases made from unregistered person under the existing law

|

Sr. No |

Name of the unregistered person |

Address |

Bill/ Invoice No |

Date |

Value of Stock |

VAT |

Central Excise |

Service Tax (if applicable |

Total |

||||||||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

||||||||||||

|

1 |

|

|

|

|

|

|

|

|

|

||||||||||||

|

2 |

|

|

|

|

|

|

|

|

|

||||||||||||

|

Total |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

10. Verification I________________________________________ hereby solemnly affirm and declare that the information given hereinabove is true and correct to the best of my knowledge and belief and nothing has been concealed therefrom. Signature of Authorised Signatory Name Designation / Status Place Date |

|||||||||||||||||||||

Allahabad High Court Provides Relief to Businesses in Landmark GST e-Way Bill Ruling. [News]

GST Amnesty Scheme: A Golden Opportunity, But Heed the Advisory - Tax Samachar [News]

Madras High Court Quashes ITC Claim Rejection Based Solely on GSTR-3B and Directs Authorities to Consider Other Returns like GSTR 2A and GSTR 9. [Blog]

Supreme Court Upholds Statutory Immunity for Officers Under GST Act: A Closer Look at the Landmark Decision [Blog]

Consultant के Foreign Client पर GST का Impact [Video]

Goods Transport Agency और Multimodel Transporter अलग अलग है [Video]