YOU ARE HERE Home > Blogs > Update Part B - Vehicle of E Way Bill

Update Part B - Vehicle of E Way Bill

GST DOST's BLOG

| Resource | Chapter 76 |

| Resource | E Way Bill |

In this blog, we have been discussed about the Part B of E Way Bill, without which E Way Bill incomplete due to following reason:

1. The validity of the e-way bill starts when first entry is made in Part-B i.e. vehicle entry is made first time in case of road transportation or first transport document number entry in case of rail/air/ship transportation, whichever is the first entry. It may be noted that validity is not re-calculated for subsequent entries in Part-B.

2. E-Way bill is complete only when Part-B is entered. Otherwise printout of EWB would be invalid for movement of goods. Filling up of Part-B of the e-way bill is a must for movement of the goods, except for within the same state movement between consignor place to transporter place, if distance is less than 50 Kms.

3. The e-way bill for transportation of goods should always have the vehicle number that is actually carrying the goods. There may be requirement to change the vehicle number after generating the e-way bill or after commencement of movement of goods, due to trans-shipment or due to breakdown of vehicle. In such cases, the transporter or generator of the e-way bill can update the new vehicle number in Part B of the EWB.

When this option can be used

This option can be used to update the vehicle number of the e-Way Bill, if it has not been entered while generating e-Way Bill or vehicle has been changed for moved goods because of various reasons like transit movement, vehicle breakdown etc.

Who will Update

The present transporter is enabled to update the Part-B. If the transporter has not been assigned to the e-way bill, the generator can update the Part-B.

User Manual

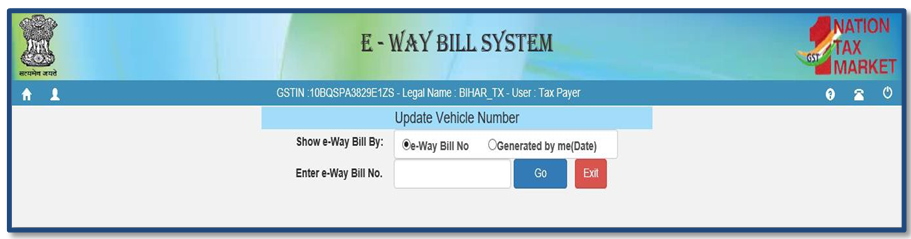

When the user selects the ‘Update Vehicle No’ sub-option under ‘e-Waybill’ option, the following screen will be displayed. In this form the user needs to check at least one option e-way bill No/ Generated Date/Generator GSTIN accordingly.

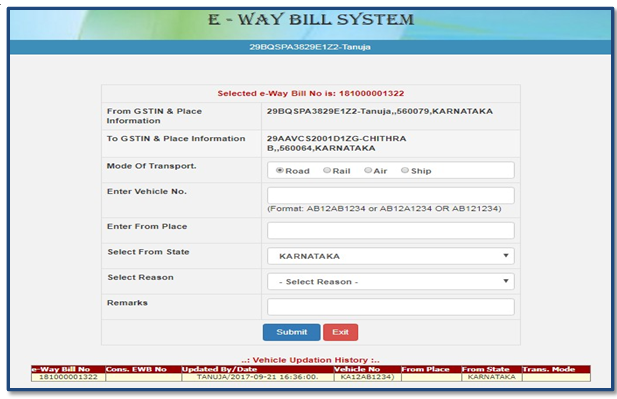

After entering the corresponding parameter, the system will show the list of related E-way bills for those parameters. Here, the user will click on the select for the corresponding e-way bill for the vehicle update. Next, the user will be redirected to the following form.

Before going for updating vehicle number, the user should have the E- Way Bill for which the user wants to update vehicle number and the new vehicle number in hand for the data entry.

In the vehicle updating form, the user needs to enter the vehicle number through which the transportation is being done, next the user enters the from place, the from state, from where the transportation is being done.

The user also needs to give the reason for which the vehicle is being changed. The system allows the user to select the reason for the transport change. Next, the user needs to enter the ‘remarks’ field. If the mode of transportation is rail, air, or ship, then the user needs to enter the transporter document number instead of the vehicle number.

Once a request for updating of vehicle number is submitted, the system validates the entered values and pops up appropriate message if there is any error. Otherwise the vehicle no is updated instantly and will be aligned with the concern e-Way Bill.

Related Links

Allahabad High Court Provides Relief to Businesses in Landmark GST e-Way Bill Ruling. [News]

GST Amnesty Scheme: A Golden Opportunity, But Heed the Advisory - Tax Samachar [News]

When a "Discount" Becomes a Taxable Incentive: Post-Sale Schemes under GST [Blog]

Mandatory ITC Reversal for Goods Exempted on 22 September 2025 – FAQ [Blog]

Consultant के Foreign Client पर GST का Impact [Video]

Goods Transport Agency और Multimodel Transporter अलग अलग है [Video]