Are you Verifying your Old HSN Codes? Read on to find Why it is Important! [Case Study - Rice Bran - 23022020 vs 230240]

GST DOST's BLOG

![Are you Verifying your Old HSN Codes? Read on to find Why it is Important! [Case Study - Rice Bran - 23022020 vs 230240] Are you Verifying your Old HSN Codes? Read on to find Why it is Important! [Case Study - Rice Bran - 23022020 vs 230240]](https://www.gstdost.com/masterboard/users/1/upload/1618052045.png )

Namaskar!

Most Businessmen have been using HSN codes for a long time. It is also a common practice to never reconfirm the HSN codes once we start using them.

Do you verify the HSN codes that you are using?

Most of you would say, what is the need?

It makes sense until you read what happened with us recently. We have an interesting story to share that will teach you an important aspect of HSN codes and will surely help you in your Business.

Just 2 days ago, we were having a conversation with our Client, Baburao Ji, who trades in Rice Bran. He told us about the HSN code that he has been using, which is HSN 23022020.

We have a company policy that we verify every HSN code provided to us by our clients in order to prevent any confusions or mistakes.

And to our Surprise, this HSN code did not even exist in the schedule of the Customs Tariff Act!

We discussed this with Baburao Ji, and he replied that this is not possible as he has been creating the E-way Bill with the same HSN code. Since the turnover of his Business was not above Rs. 50 Crores, so we could not ask him about the E-invoice.

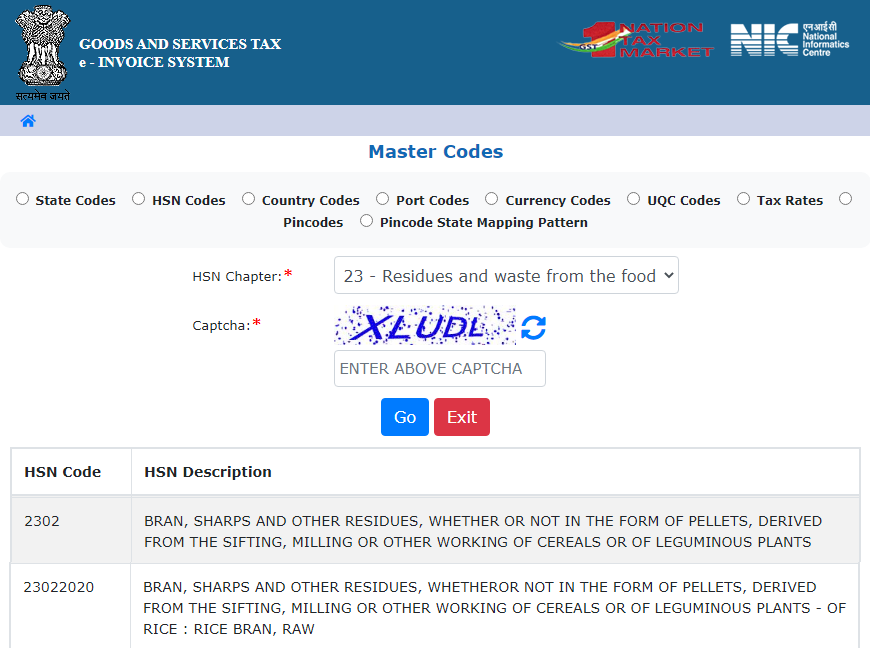

We then talked to Raghvan Ji, who is an exporter, and he also said the same thing that the HSN code must be valid as it has been used to create the E-way Bills for the Business. He shows us the Master HSN List downloaded from E-Invoice Portal.

We were literally astonished!

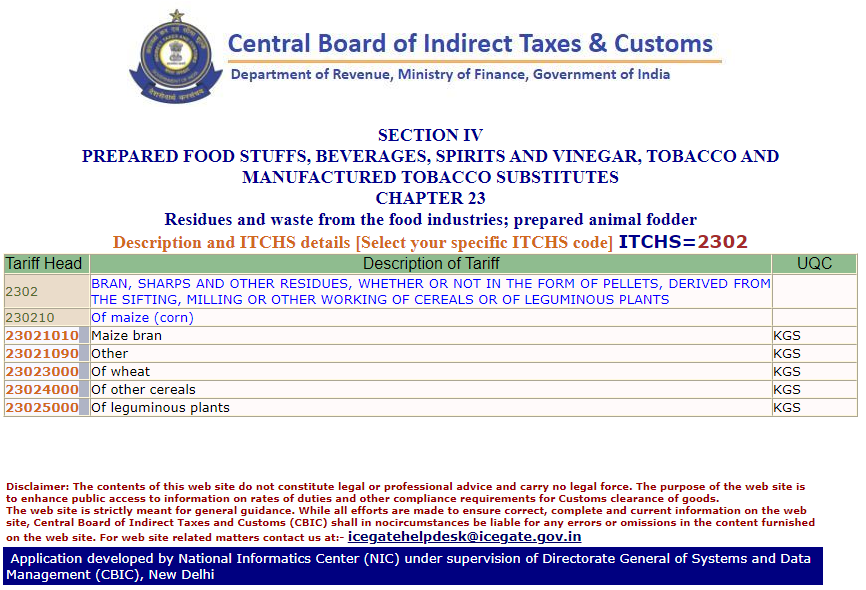

We asked our team to confirm the same on ICEGATE's website, but nothing like the HSN 23022020 existed there. We even tried reaching the customs Office but did not get any logical explanation for this scenario.

We also asked about this from a few Officers who told us that there is nothing to worry about if the E-way Bill is getting generated.

What is actually happening here?

Our team became even more curious after this, and we wanted the answer to this situation, and after a lot of research and efforts, we found the answer!

To get to know about the Tariff history, we went to the World Customs Organisation website and purchased a subscription.

After getting the subscription, we found out that just like GST, amendments are made in the classification of codes from time to time.

This is what has happened in the case of Rice Bran. The code has changed!

The custom portal is connected to WCO, this is why we can get to see the latest changes, but changes in the GST portal have not been done.

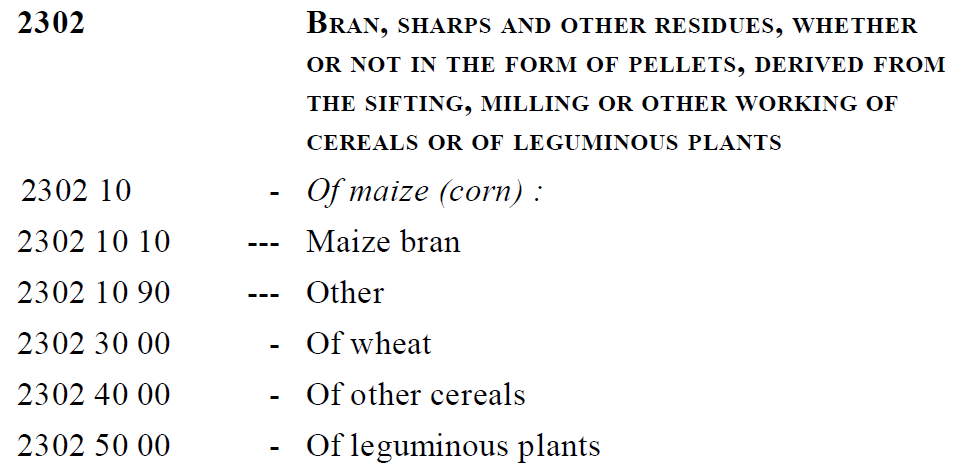

For your knowledge, we wish to share that the HSN code for Rice Bran will be 23024000

But does it actually affect me?

This is really fascinating to see how the system works, but you must be wondering how will it affect me?

What would happen if I continue to use the old HSN codes?

Here are the problems that you might face:

1. If you are an importer or exporter, you won't be able to generate the Bill of entry or the Shipping Bill with the same HSN code.

However, in this particular case, we know that the export of Rice Bran is Banned.

2. Also, the GST portal is interlinked with ICEGATE, and as the Department is using Data Mining as well as Text Mining Techniques, the software will detect a mismatch in the HSN codes and raise a red flag.

This can lead to a notice from the Department and numerous other issues.

You may explain your case to the Officers who investigate the notice, but I am sure you can imagine the problems you will have to face when you get a notice from the Department.

What all to know and take care of to get healthy sleep?

We would advise you to verify your HSN code not only with the Schedule of the Customs Tariff Act but also with General Rules for Interpretation.

Here are some examples that will explain how small changes in the description of a product can change the HSN code.

1. Is Tamarind agricultural produce or forest produce?

2. Are we supposed to share the HSN code or the SAC code in case of packaged software that is not customized?

3. If we are renting out a portion of our home, e.g., in the case of a Rooming House, will we use the SAC code of a Residential Dwelling or Accommodation.

4. A seller is selling a set of Kids Jeans and a T-shirt. The T-shirt is made from Ganji fabric, and the Jeans are made from another fabric. What codes will be used while selling this as a set and Individually?

There are just a few examples, and there are hundreds of others.

We are sharing this with you to encourage you to reconfirm your HSN code / SAC code which will help you avoid numerous issues in the Future.

If you have any Doubt related to anything linked to GST, feel free to contact GST DOST, and we will help solve your concerns along with Life-changing solutions for your Business!!!

T: 90 8888 3000

E: support@gstdost.com

₹31.95 Crore Fake ITC Fraud Busted by CGST Delhi South; Company Director Arrested [News]

CBIC Notifies New Rule 14A – Quick GST Registration Option for Small Taxpayers [News]

The Guwahati High Court Read Down Section 16(2)(aa) and Thereby Allowed ITC [Blog]

ITC Cannot Be Denied Due to Retrospective GST Cancellation, But Subject to Conditions [Blog]

Gujarat HC says:“Phone calls don’t count as hearings!”Know your rights under Sec 75(4) [Video]

Know GST Rate of HSN 3926 | GST DOST [Video]